The Nitty Gritty

- Discover the top features to look for when searching for the best billing apps

- Find out which invoicing apps are the best on the market

- Understand how to choose the best invoice app for your business

So you got the job, you've been working on it for weeks, and now it's finally time to sit back and appreciate your work. And, more importantly, get paid for it.

Unfortunately, it's not quite as easy as saying, "You owe me $X." For most businesses — and especially those in the trades — invoices are the best way to make sure you get what's due to you. That said, handing over a paper invoice these days often means more work for you, payment delays and more hassle for your customer.

The best way to ensure you get properly compensated for your work is through digital invoicing. Not only does it mean you never have to lug around a clipboard with a bunch of paper invoice templates on it, the best invoicing apps can also streamline bookkeeping, taking payments and more.

The Rising Need for Specialized Invoicing Apps for Small Business

As a small business, the invoicing apps you need to streamline your financial management processes aren't the same as what enterprise companies need. Depending on your business, the features you need for invoicing won't necessarily match what another company needs.

Of course, there are non-negotiables: digital invoices (that look nice), templates for different types of jobs or customers, as well as archives and record-keeping for tax time. But at the end of the day, when you're looking for software to help you with your business, it's better to get exactly what you need without all the frills of a solution meant for much larger businesses or those in a different industry.

Luckily, there are a lot of options out there so you can find the perfect fit. To help you find it, we'll cover the top features and then a few of the best options for different types of companies.

Top Features to Look for in the Best App for Invoicing

Regardless of what trade your business is in and whether you need HVAC invoicing, plumbing invoicing or something else, here are some of the non-negotiable features we mentioned earlier, as well as a few to help you go the extra mile.

Ease of use

Chances are, if an app is difficult to use, you won't use it. So, the first thing you must look for is a user-friendly interface that you can pick up on quickly. There's nothing worse than keeping a customer waiting by fiddling around on your laptop or phone trying to get an invoice together. Or worse, having to wait until you're back at the office. It's not worth your frustration or time wasted on difficult-to-use software.

That said, every software comes with a learning curve. The difference between an easy-to-use app and a challenging one lies in how big that learning curve is. When you demo or trial an invoicing app, make sure you can quickly see where its main features are. Then, take a look at the support documents. How comprehensive the app's support documents are will give you an indication as to how difficult the system is.

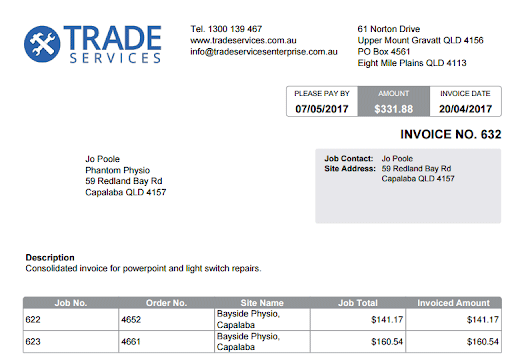

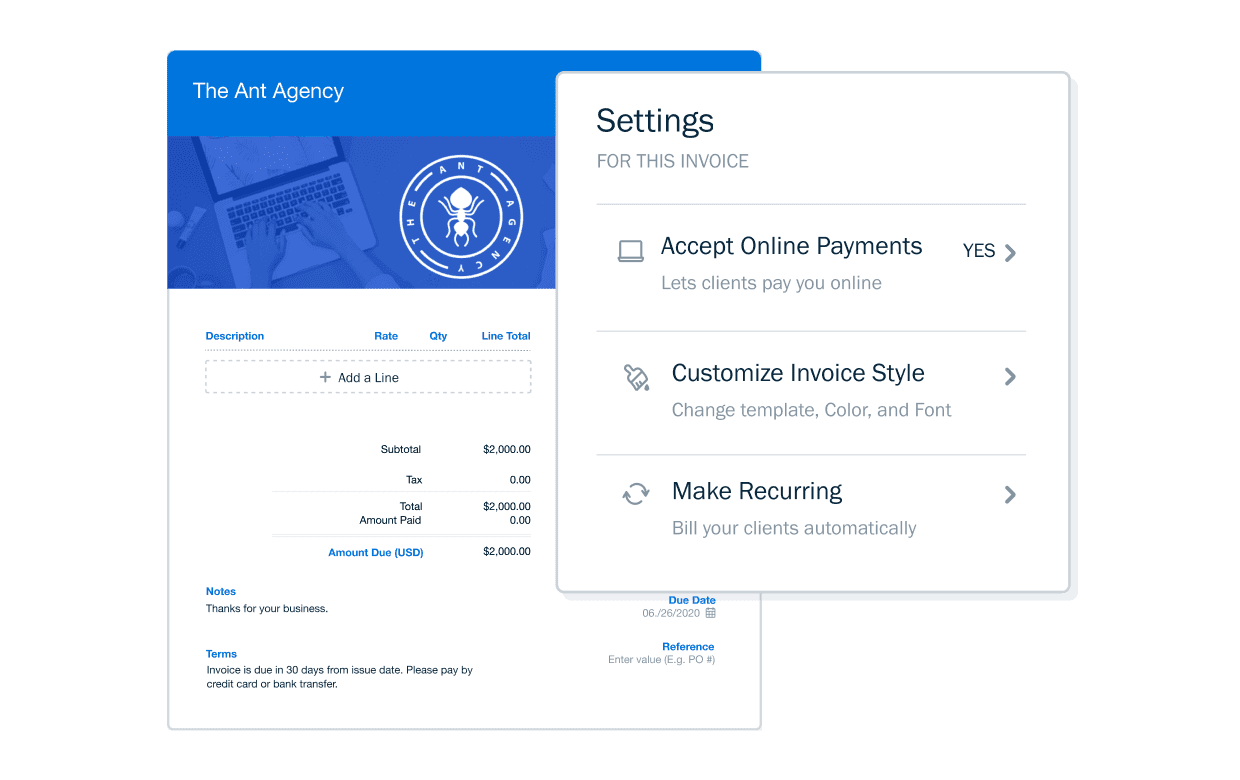

Customizable invoice templates

While ease of use is certainly first on the list, a close second is professionalism. After all, you're getting an invoicing app to make your business life easier and increase customer satisfaction. Depending on your services, you'll need at least one template to create invoices from.

However, the best invoice apps will not only have a set of templates that you can use, but they'll also let you customize or create them from scratch. This ensures you have invoices that fit your business, and give your customers all of the information they need for the work carried out.

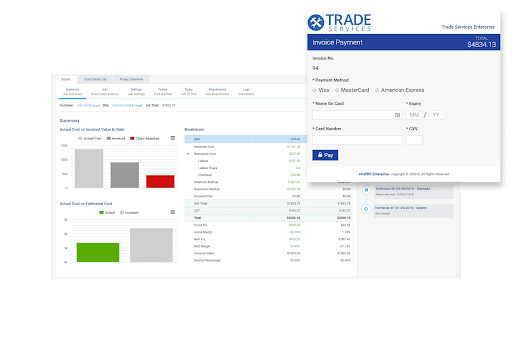

Payment portal

What good is an invoice app that doesn't include a payment portal (or at least an integration with one)? No matter what type of business you run, no matter what field you operate in, and no matter what customers you have or services you offer, invoicing and payments go hand in hand.

What sets good billing apps apart from the best apps for invoicing is their rates. Pretty much any invoice app will let you accept credit cards, but how much those payments cost you will differ from app to app. As you're evaluating which software works best for your business, check how much the processing fees will cost you and add that to the app's price.

The best invoicing apps will also let you accept multiple types of payments. There's a lot more than cash, check or card these days, and your business needs to accept all of them to keep your customers happy.

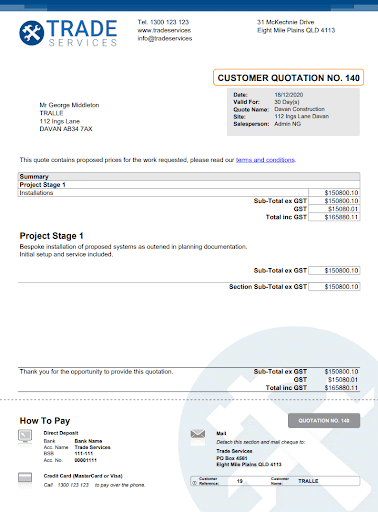

Estimates and quotes

Before you can even offer an invoice for a completed job, you must be able to give an estimate or quote. And for a lot of trade businesses, estimates and quotes are key to job profitability. After all, if you lowball yourself, it means reduced profit. But give an estimate that's too high, and you risk losing the job entirely.

So, the best invoice apps often include estimating and quoting functionality to make invoicing that much easier. If you want to make your financial and billing processes even better, find an invoicing app that will help you price out jobs. Plus, quickly create estimates and invoices from a set stock of products and services.

Mobile app and cloud storage

When you're in the field, you need invoicing software for field service businesses. This means you need to have access to information no matter where you are, and be able to create estimates, invoices and more on the go. So, as you're evaluating invoice apps, ensure the ones you're looking at will let you do what you need to do on-site. On top of invoice creation, you also need to be able to pull information about jobs and customers both in and out of the office. At the very least (and we'll get into this in a bit), that means your chosen invoicing app should integrate with a customer relationship management system (CRM) or a bookkeeping platform. The best invoicing apps will also be able to store certain documents for you for easy retrieval.

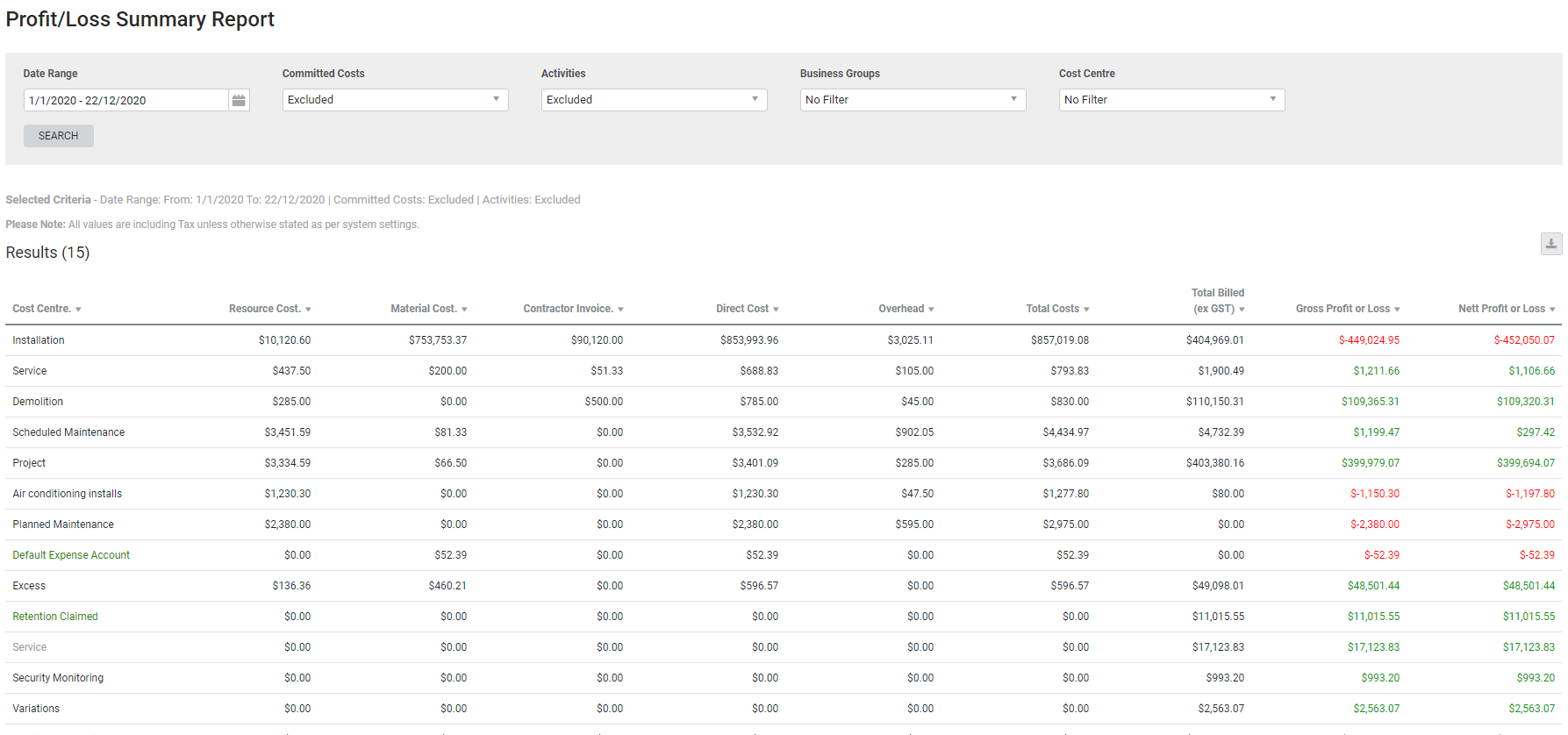

Reporting

Whenever you're dealing with finances, reporting is a must-have feature. And we don't just mean reporting for tax time.

For your business to succeed, you need to be profitable. This means you understand your profit margin and markup. You know your materials and labor cost. And you at least have a projection for how much money you'll make this month, quarter and year. When you choose your invoicing app, it must be able to report on your business's financial health and give you the insights necessary to keep yourself in the green.

Billing app integrations

As you scale your business, you'll naturally start implementing more software. A key consideration is ensuring they all play nicely with each other. By integrating your software into a "tech stack," you can make sure all the systems you use share data and help you make better business decisions.

Integrations can also vastly improve your business's efficiency. Rather than uploading your invoices to your CRM and attaching them to a customer, for instance, if the two apps are integrated, they can sync information without you lifting a finger.

As we said earlier, the bare minimum integration your billing app should have is with a payment portal (if it doesn't have a payment portal itself). Otherwise, the other integrations you need to lookout for are CRMs, accounting/tax software and finally, marketing and review-gathering tools.

The Best Invoice Apps: In-Depth Reviews

Now that you know the features you need in your invoicing app, let's go over some of the best invoicing apps in the business.

Simpro: Best invoice app for field service businesses

Featured Review: "As someone who uses Simpro in all areas of the product and helped implement it to our company, it is overall one of the best I have ever used in my 10+ years of working here." - Melissa on G2

Specialty: Made for and by tradies, it's the best all-in-one software for any business within the field service industry.

About Simpro: Simpro is a field service management platform that helps trades businesses of all kinds more easily and efficiently manage their company. It includes everything a growing business needs to streamline its current efforts as well as scale into future growth. The software helps you tackle any part of your day: getting in front of customers, creating better relationships, finding and landing jobs, to invoicing and taking payments.

Its invoicing capabilities, specifically, are the most robust on the list, with functionality for estimates and quotes, takeoffs, one-off and recurring payments, payment portals, integrations and a heck of a lot more. It even has a mobile app that you can use with many of its features, not just invoicing (Hello, fleet tracking!). Think of Simpro like your business management toolbox, where everything's in the right spot so you can keep focused on your business.

Pros & Cons:

- All-in-one, fully-featured software to help you throughout jobs, from when you first get a customer to payment, and everything in between.

- Robust invoicing features that help make things easy for you and your customers.

- No public pricing, so you'll have to go through a demo to learn what it'll cost you.

- Might be too powerful a tool for a single contractor or particularly small businesses.

How to Get Started: Request a demo or call (855) 338-6041

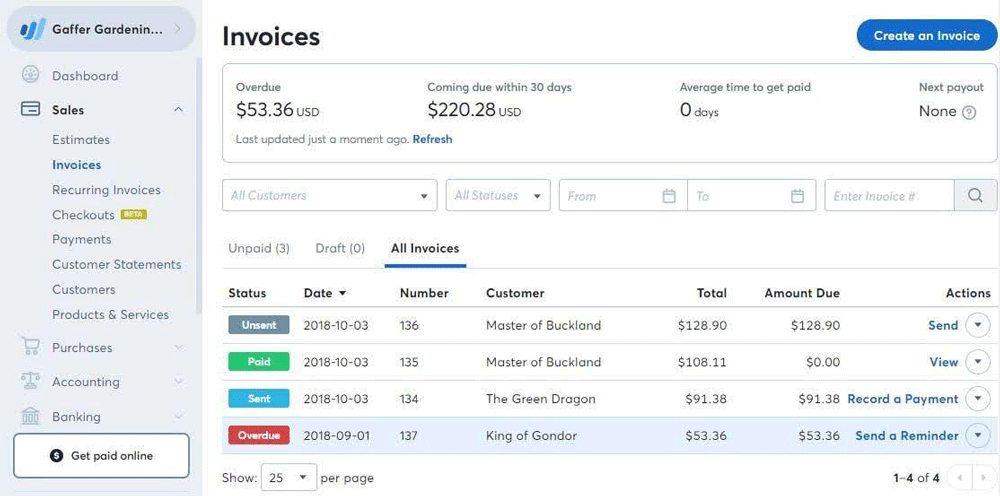

FreshBooks: Best invoice app for small businesses

Featured Review: "Using FreshBooks has been a game changer for me and my team. The platfom excels in accounting and expense management, [and] it offers a variety of functions such as generation and tracking of invoices." - Adam on Software Advice

Specialty: A bookkeeping app, first and foremost, if all you want is the ability to create and send invoices for a few customers, FreshBooks might be the perfect fit.

About FreshBooks: As the name suggests, FreshBooks is all about keeping your books — that is, your financial records — up-to-date and flush with payments from customers. It's offered mainly as a bookkeeping and accounting software, with a focus on helping you create customer invoices and then prepare for tax time.

The software has a number of capabilities, including automatically pulling in some of your bank transactions, but those may not be available depending on what plan you choose, so keep that in mind when looking over their offerings. Otherwise, FreshBooks offers invoice creation, payment portals, tax reports, time tracking, recurring billing and even accountant access on certain plans.

Pros & Cons:

- All the basics of an invoicing app in a convenient cloud-based package and mobile app.

- Starts at only $17/month with discounts for annual pricing.

- Only allows one user unless you cough up $11/month each.

- Basic approach to invoicing and bookkeeping and some essential features are locked behind higher-tier plans.

Wave: Best free invoice app

Featured Review: "It's a great software and works well for my basic use case as a solopreneur. The payments feature is also nice and the reporting is great." - Anonymous on GetApp

Specialty: It's free (+ credit card processing fees if you use their payment portal).

About Wave: If you need invoicing yesterday, Wave (formerly Wave Accounting) is a great app to get you there. They are the "no-frills" captains of the invoicing software seas, with everything you need for basic invoicing, payments and accounting. So if your only desire is to make invoices, collect payments and see if you're in the green, Wave might be your best option.

The best part about Wave is that they don't charge a monthly fee. If you use them for payments, you'll pay a nominal — if slightly higher than other payment providers — fee for each payment you send through their system. They also offer payroll features, though those do come with a $40/month price tag (+$6/month for each employee or contractor).

Pros & Cons:

- No monthly fee for invoicing, accounting or payments.

- Clean, user-friendly interface that's built for a normal human to be able to understand and use.

- You get what you pay for: it's the most basic offering, feature-wise, of the bunch.

- Limited reporting features, which may make tax time more difficult than it should be.

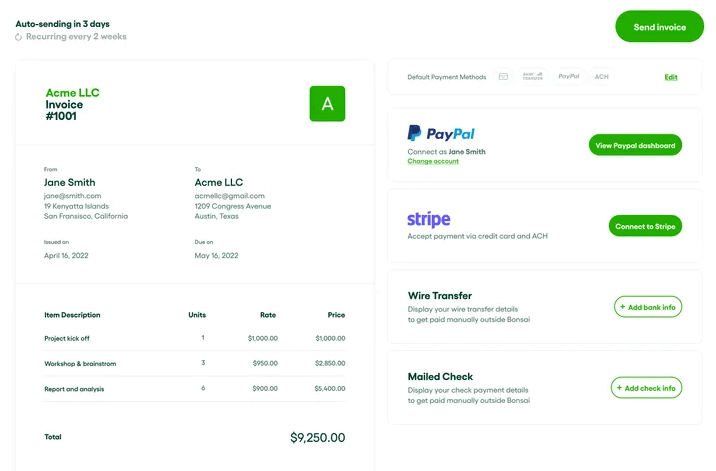

Bonsai: Best invoice app for contractors

Featured Review: "As a small consulting firm, this software really helps me from proposal to payment. It makes it so easy to manage multiple clients, multiple projects, and multiple invoices." - Danielle on TrustPilot

Specialty: If it's just you and you're a contractor, Bonsai is one of the best solopreneur invoicing apps out there

About Bonsai: Formerly known as Hello Bonsai, Bonsai is often touted as the best invoicing app for freelancers and contractors. Much like many of the other apps on our list — other than Simpro — Bonsai doesn't specifically speak to the needs of field service professionals, but the features they offer can be molded to fit any contractor in any industry. Bonsai's platform extends to a few capabilities outside of just invoicing, from payments and client management to project management and bookkeeping. (Plus, if you're looking for help with making contracts, Bonsai has a great, lawyer-vetter creator to get you started).

Pros & Cons:

- Perfect for solopreneuers and contractors looking for an inexpensive app to help manage their business.

- Includes a basic CRM, client intake forms, invoicing, payments, finance tracking, appointment creation and contracts.

- Only one user is included in their plans, and extra users cost $10/month each.

- While necessary for security, Bonsai's identity verification methods will put your funds on hold and multiple reviews state difficulty with verification.

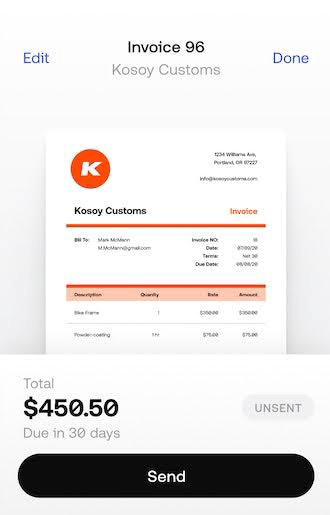

Invoice2Go: Best mobile-first invoice app

Featured Review: "The ease of use makes invoicing so much less time-consuming and allows me to spend that time improving my business!" - Barbara on Capterra

Specialty: If you're never in the office (or don't even have an office) and your phone is your only device, Invoice2Go can help you stay on top of your finances.

About Invoice2Go: While some of us remember the days before a computer in your pocket was a reality, much less necessary, the fact is they've made both our personal and business lives a lot easier. And if you want your smartphone to be your miniature digital office for sending invoices, Invoice2Go is designed to be solely used from your phone. Because of that design choice, you trade off some of the more advanced features that other invoicing apps can offer you.

Pros & Cons:

- Mobile-first, easy-to-use design.

- Includes review solicitation, appointment booking, time tracking and a few other features that you'd find in more expensive options.

- Limits the number of invoices you can create per year on the lower plans.

- Big jump in pricing from their mid-tier ($99/year) to highest-tier plan ($399/year).

How to Choose the Right Invoicing App for Your Business

Every business is different and there are many factors which determine the best app for invoicing for your company. Depending how many customers you have, how often you have to create invoices, whether you have employees and more, you need to carefully consider your business to choose the best invoicing app.

Assess your specific business needs

What are you having the most issues with today? You came here because you need help with invoicing, sure, but what else do you need help with? Collecting payments? Making estimates? Soliciting reviews? Or a mix of everything?

Look at your business and see where the sticking points are. Then, start making a list of what you need to improve your business and internal workflows. Mark places where you're spending too much time on a process or when something falls through the cracks. If you have employees, ask them what they think could be improved or where they're having difficulty with their day-to-day when it comes to invoicing, estimates or payments.

Compare pricing, features, and support

Just as every business is different, so too are the available choices for invoicing apps. Starting from your final list of business needs, create a checklist and compare the features of the apps you're vetting. Then, do a detailed analysis of pricing. Remember, many invoicing apps will have a monthly fee separate from their payment processing fees.

Once you have a final gauge of pricing and features, poke around in the app’s support areas. See what information is freely available (and how easy it is to understand) and ask your sales rep what other support options are included with the plan you're most interested in.

Future-proof your choice: Scalability and updates

Finally, look at what it takes to get more from the platform. What happens to the price if you want to add more users? What about if you want a certain feature in the future? Will that require a new add-on or upgraded plan? Or, is it already there, just waiting for when you're ready?

Then, do some digging into the app's release notes and reviews to see how often new features are added or fixes are released. When you choose an invoicing app, you want to ensure you'll be able to stick with it for a long time. So, doing your due diligence to make sure it works for you both now and into the future will save you a lot of headaches.

Embrace the Future of Invoicing

Ready to take on the future of your business? It's time to get out of the paper invoicing and finances business and into the digital one. Not only will you save considerable time and money, but you'll also be well set up for future success.

If you want to see how efficient your business could be with a modern, fully-featured field service management platform — with all the features we listed above and many more to help you run all parts of your trades business — we'd love to show you. Request a demo today.